AI Directory : Legal Assistant, Tax Assistant

What is TaxGenius?

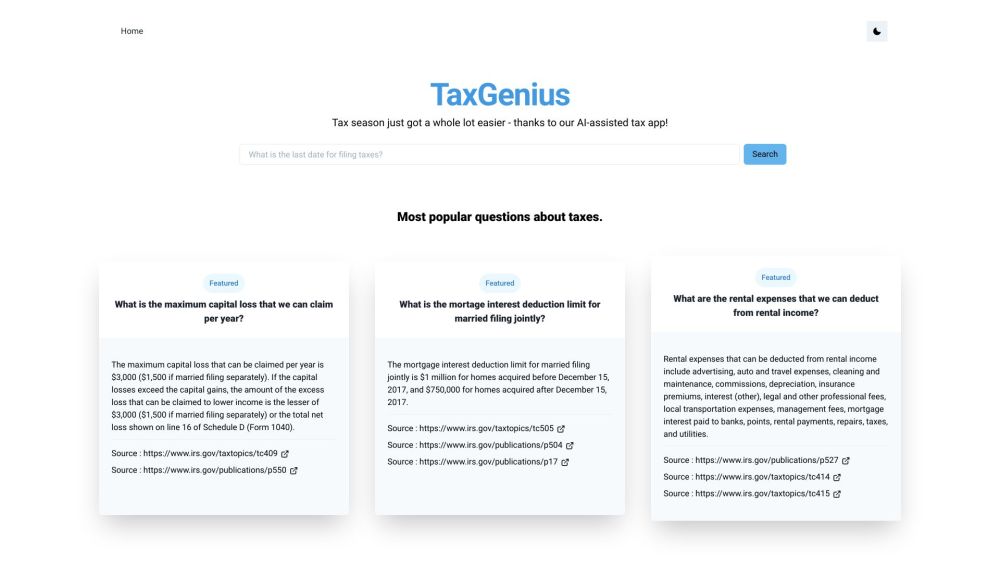

TaxGenius is an AI-assisted tax app designed to make tax season easier for users. It leverages the power of AI technology to answer tax-related questions.

How to use TaxGenius?

Using TaxGenius is simple. Just open the app, enter your tax question, and let the AI technology provide you with the answer. You can search for the most popular questions about taxes or explore various tax topics for detailed information.

TaxGenius's Core Features

AI-assisted tax app

Accurate and up-to-date tax information

Search for popular tax questions

Explore various tax topics

Instant answers to tax queries

TaxGenius's Use Cases

Getting quick answers to tax-related queries

Navigating through complex tax topics

Understanding deductions, credits, and limits

Maximizing tax savings

Gaining confidence in filing taxes

FAQ from TaxGenius

What is TaxGenius?

TaxGenius is an AI-assisted tax app designed to make tax season easier for users. It leverages the power of AI technology to answer tax-related questions.

How to use TaxGenius?

Using TaxGenius is simple. Just open the app, enter your tax question, and let the AI technology provide you with the answer. You can search for the most popular questions about taxes or explore various tax topics for detailed information.

What is the maximum capital loss that can be claimed per year?

The maximum capital loss that can be claimed per year is $3,000 ($1,500 if married filing separately).

What is the mortgage interest deduction limit for married filing jointly?

The mortgage interest deduction limit for married filing jointly is $1 million for homes acquired before December 15, 2017, and $750,000 for homes acquired after December 15, 2017.

What are the rental expenses that can be deducted from rental income?

Rental expenses that can be deducted from rental income include advertising, auto and travel expenses, cleaning and maintenance, commissions, depreciation, insurance premiums, interest (other), legal and other professional fees, local transportation expenses, management fees, mortgage interest paid to banks, points, rental payments, repairs, taxes, and utilities.