AI Directory : AI Product Description Generator, Investing Assistant

What is Kvants.AI - Decentralized Asset Management Platform?

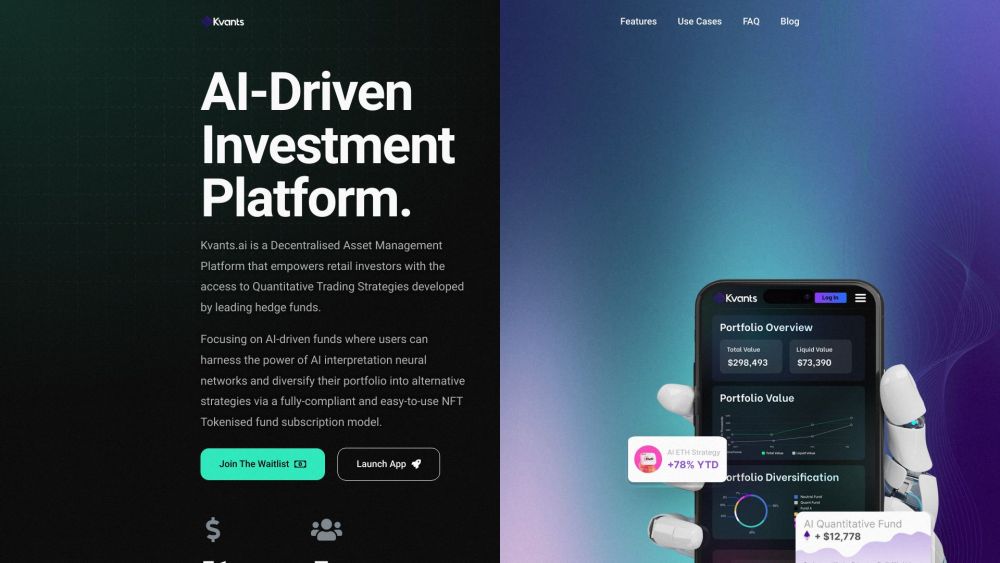

Kvants.AI is a decentralized asset management platform that empowers retail investors with access to tokenized quantitative algo trading strategies developed by hedge funds. It offers institutional-level AI-driven trading strategies, allowing investors to invest in strategies that were previously only available to a select few. By leveraging AI and machine learning, Kvants.AI aims to make and support better investment decisions for retail investors.

How to use Kvants.AI - Decentralized Asset Management Platform?

To use Kvants.AI, follow these steps: 1. Mint a KYC NFT: Complete the Know Your Customer (KYC) process and verify your identity to gain access to the Kvants ecosystem. 2. Stake a $KVNT tier: Stake a collateral corresponding to your desired investment amount. 3. Explore available strategies: Review the fundamentals and performance metrics of the AI-driven trading strategies on the platform. 4. Select an AI-driven trading strategy: Choose a strategy that suits your risk appetite and maturity period. 5. Invest in the selected strategy: Deploy your capital into the fund by minting the Subscription NFT, representing your contribution to the fund.

Kvants.AI - Decentralized Asset Management Platform's Core Features

Access to tokenized quantitative algo trading strategies

Institutional-level due diligence and analysis

Fractionalized fund subscription model

Transparency in investment process

Regular strategy performance updates

Video explainers for better understanding

Full KYC/AML compliance

KvantDAO governance for platform direction

Kvants.AI - Decentralized Asset Management Platform's Use Cases

Diversify crypto portfolio via institutional-level trading strategies

Capitalize on market volatility with volatility-based strategy

Profit from negative maker fees with market making strategy

Exploit differences in funding rates through funding rate arbitrage

Kvants.AI - Decentralized Asset Management Platform Sign up

Kvants.AI - Decentralized Asset Management Platform Sign up Link: https://app.kvants.ai/kyc

Kvants.AI - Decentralized Asset Management Platform Linkedin

Kvants.AI - Decentralized Asset Management Platform Linkedin Link: https://www.linkedin.com/company/kvants/

Kvants.AI - Decentralized Asset Management Platform Twitter

Kvants.AI - Decentralized Asset Management Platform Twitter Link: https://twitter.com/kvantsai

Kvants.AI - Decentralized Asset Management Platform Instagram

Kvants.AI - Decentralized Asset Management Platform Instagram Link: https://www.instagram.com/kvantsai/

FAQ from Kvants.AI - Decentralized Asset Management Platform

What is Kvants.AI - Decentralized Asset Management Platform?

Kvants.AI is a decentralized asset management platform that empowers retail investors with access to tokenized quantitative algo trading strategies developed by hedge funds. It offers institutional-level AI-driven trading strategies, allowing investors to invest in strategies that were previously only available to a select few. By leveraging AI and machine learning, Kvants.AI aims to make and support better investment decisions for retail investors.

How to use Kvants.AI - Decentralized Asset Management Platform?

To use Kvants.AI, follow these steps:n1. Mint a KYC NFT: Complete the Know Your Customer (KYC) process and verify your identity to gain access to the Kvants ecosystem.n2. Stake a $KVNT tier: Stake a collateral corresponding to your desired investment amount.n3. Explore available strategies: Review the fundamentals and performance metrics of the AI-driven trading strategies on the platform.n4. Select an AI-driven trading strategy: Choose a strategy that suits your risk appetite and maturity period.n5. Invest in the selected strategy: Deploy your capital into the fund by minting the Subscription NFT, representing your contribution to the fund.

What is Kvants.AI and what does it offer?

Kvants.AI is a decentralized asset management platform that offers access to AI-enabled trading strategies developed by leading hedge funds. It provides retail investors with the opportunity to invest in strategies that were previously only available to a select few.

What is the core product of Kvants.AI?

The core product of Kvants.AI is its decentralized asset management platform, which offers retail investors access to institutional-level tokenized funds.

What is Kvants.AI's vision?

Kvants.AI aims to bring the power of AI-driven algorithmic trading to retail investors' portfolios via an intuitive platform. It strives to lower the barrier of entry and enable retail investors to access alternative investment methods for alpha generation and portfolio growth.

How can Kvants.AI provide investors with a diversification edge?

Kvants.AI provides AI-driven trading strategies that can analyze vast amounts of data and quickly identify patterns and trends. This enables investors to diversify their portfolios by capitalizing on market movements, such as volatility, and taking advantage of emerging opportunities.

What is the role of the Kvants DAO Governance?

The Kvants DAO Governance provides a decentralized governance model for the platform, where token holders can propose and vote on changes. It also grants exclusive rights to receive monthly payouts from the fund's performance and other benefits based on token ownership and participation.

What is an NFT-based fund subscription?

An NFT-based fund subscription allows users to subscribe to a fund on a decentralized NFT model basis. It grants access to a range of AI-driven quantitative trading strategies and their returns.

How does the Kvants platform accommodate regulatory compliance?

The Kvants platform requires users to complete the full Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance process. It ensures a safe and compliant investment platform for retail investors.

What are the deflationary token economics of the $KVANT token?

The $KVANT token has deflationary token economics, where a portion of the platform's performance fees are used to buy back and burn the token from the open market. This decreases the circulating supply and contributes to the token's value.