AI ディレクトリ : AI Chatbot, AI Project Management, AI Task Management, AI Workflow Management

What is FinanceOps?

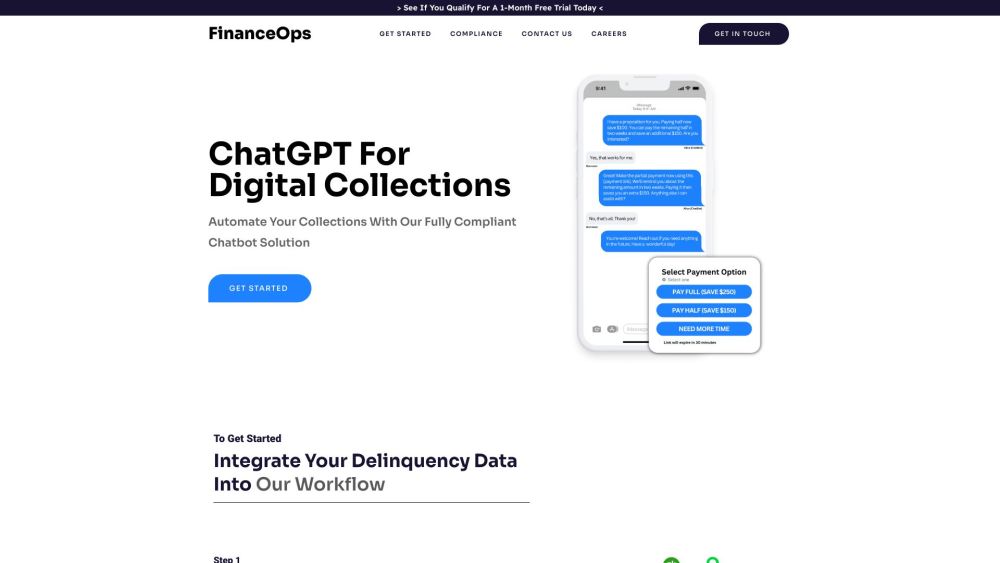

FinanceOps is a financial operations platform that offers a fully compliant chatbot solution designed to automate collections processes. It integrates with popular ERP tools and leverages advanced algorithms to optimize collections and maximize results. The platform focuses on streamlining collections, delivering targeted interactions, reducing overhead expenses, accommodating increased volumes, and ensuring compliance with US debt collection rules and laws.

How to use FinanceOps?

To use FinanceOps, follow these steps: 1. Connect your ERP tool: If you already use an integrated ERP tool, you can quickly start by connecting it to FinanceOps. 2. Integrate delinquency data: Map and configure your customer delinquency data from ERP tools like QuickBooks, Xero, Sage, NetSuite, Salesforce, etc., into FinanceOps dashboard. 3. Customize collection settings: Personalize your collection settings, including tone, loan criteria, and settlement limits. 4. Launch Autopilot: Let FinanceOps take charge with its intelligent system, which uses advanced algorithms and personalized strategies to optimize collections and engage with customers.

FinanceOps's Core Features

Integration with popular ERP tools

Data mapping and configuration for accurate and reliable performance

Fully compliant with US debt collection rules and laws (FDCPA, CPA, CCPA)

Customizable collection settings for tailored approach

Automated collections process for streamlining operations

Targeted interactions with customers

24/7 support for collection inquiries via SMS

Escalation to live agents when necessary

Cost-effective solution reducing overhead expenses

Scalability to accommodate increased volumes

FinanceOps's Use Cases

Streamline collections processes by automating repetitive tasks

Improve efficiency and effectiveness of collections operations

Deliver personalized interactions to improve customer experience

Reduce compliance risks by operating within the framework of debt collection laws

Offload the burden of collections to focus on core business activities

FinanceOps Support Email & Customer service contact & Refund contact etc.

More Contact, visit the contact us page(https://financeops.ai/contactus/)

FinanceOps Company

FinanceOps Company name: FinanceOps .

More about FinanceOps, Please visit the about us page(https://financeops.ai/about/).

FinanceOps Youtube

FinanceOps Youtube Link: https://www.youtube.com/watch?v=MLpWrANjFbI

FAQ from FinanceOps

What is FinanceOps?

FinanceOps is a financial operations platform that offers a fully compliant chatbot solution designed to automate collections processes. It integrates with popular ERP tools and leverages advanced algorithms to optimize collections and maximize results. The platform focuses on streamlining collections, delivering targeted interactions, reducing overhead expenses, accommodating increased volumes, and ensuring compliance with US debt collection rules and laws.

How to use FinanceOps?

To use FinanceOps, follow these steps:n1. Connect your ERP tool: If you already use an integrated ERP tool, you can quickly start by connecting it to FinanceOps.n2. Integrate delinquency data: Map and configure your customer delinquency data from ERP tools like QuickBooks, Xero, Sage, NetSuite, Salesforce, etc., into FinanceOps dashboard.n3. Customize collection settings: Personalize your collection settings, including tone, loan criteria, and settlement limits.n4. Launch Autopilot: Let FinanceOps take charge with its intelligent system, which uses advanced algorithms and personalized strategies to optimize collections and engage with customers.

Which ERP tools does FinanceOps integrate with?

FinanceOps integrates with popular ERP tools such as QuickBooks, Xero, Sage, NetSuite, Salesforce, and others.

What data can be mapped and configured in FinanceOps?

In FinanceOps, you can map and configure customer information, invoice details, payment history, aging information, communication history, and account status.

Does FinanceOps comply with debt collection laws?

Yes, FinanceOps is designed to operate within the framework of US debt collection rules and laws, including FDCPA, CPA, and CCPA.

Can FinanceOps provide support for collection inquiries?

Yes, FinanceOps offers 24/7 support for collection inquiries via SMS. The chatbot is trained to handle a wide range of 1st party collection matters.

Is FinanceOps cost-effective?

Yes, FinanceOps reduces overhead expenses by streamlining collections processes, automating tasks, and delivering targeted interactions.