KI-Verzeichnis : AI Chatbot, AI Project Management, AI Task Management, AI Workflow Management

Was ist FinanceOps?

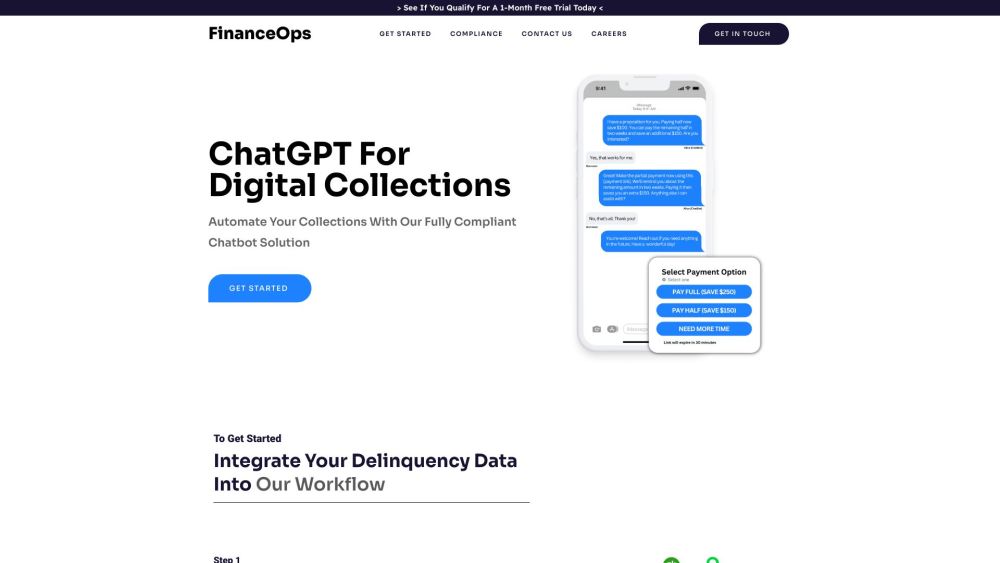

FinanceOps ist eine Finanzoperationsplattform, die eine vollständig konforme Chatbot-Lösung bietet, die darauf ausgelegt ist, Inkassoprozesse zu automatisieren. Es integriert sich in beliebte ERP-Tools und nutzt fortschrittliche Algorithmen, um Inkassoprozesse zu optimieren und maximale Ergebnisse zu erzielen. Die Plattform konzentriert sich auf die Rationalisierung von Inkassoprozessen, die Bereitstellung gezielter Interaktionen, die Reduzierung von Gemeinkosten, die Bewältigung erhöhter Volumina und die Einhaltung der US-Schuldeneintreibungsregeln und -gesetze.

Wie benutzt man FinanceOps?

Um FinanceOps zu verwenden, folgen Sie diesen Schritten: 1. Verbinden Sie Ihr ERP-Tool: Wenn Sie bereits ein integriertes ERP-Tool verwenden, können Sie schnell starten, indem Sie es mit FinanceOps verbinden. 2. Integrieren Sie Delinquenzdaten: Mappen und konfigurieren Sie Ihre Kundendelinquenzdaten von ERP-Tools wie QuickBooks, Xero, Sage, NetSuite, Salesforce usw. in das FinanceOps-Dashboard. 3. Passen Sie die Inkassoeinstellungen an: Personalisieren Sie Ihre Inkassoeinstellungen, einschließlich Ton, Kreditkriterien und Abwicklungslimits. 4. Starten Sie den Autopiloten: Lassen Sie FinanceOps die Kontrolle übernehmen mit seinem intelligenten System, das fortschrittliche Algorithmen und personalisierte Strategien verwendet, um Inkassoprozesse zu optimieren und mit Kunden zu interagieren.

Kernfunktionen von FinanceOps

Integration mit beliebten ERP-Tools

Datenmapping und -konfiguration für genaue und zuverlässige Leistung

Vollständig konform mit US-Schuldeneintreibungsregeln und -gesetzen (FDCPA, CPA, CCPA)

Anpassbare Inkassoeinstellungen für einen maßgeschneiderten Ansatz

Automatisierter Inkassoprozess zur Rationalisierung der Abläufe

Gezielte Interaktionen mit Kunden

24/7 Unterstützung für Inkassoanfragen per SMS

Eskalation zu Live-Agenten bei Bedarf

Kosteneffiziente Lösung zur Reduzierung von Gemeinkosten

Skalierbarkeit zur Bewältigung erhöhter Volumina

Anwendungsfälle von FinanceOps

Rationalisierung von Inkassoprozessen durch Automatisierung sich wiederholender Aufgaben

Verbesserung der Effizienz und Effektivität von Inkassoprozessen

Bereitstellung personalisierter Interaktionen zur Verbesserung der Kundenerfahrung

Reduzierung von Compliance-Risiken durch Einhaltung der Schuldeneintreibungsgesetze

Entlastung von Inkassoaufgaben, um sich auf Kernaktivitäten zu konzentrieren

FinanceOps Support-E-Mail & Kundenservice-Kontakt & Rückerstattungskontakt usw.

Weitere Kontaktinformationen finden Sie auf der Kontaktseite (https://financeops.ai/contactus/)

FinanceOps Unternehmen

FinanceOps Firmenname: FinanceOps.

Weitere Informationen über FinanceOps finden Sie auf der Über uns Seite (https://financeops.ai/about/).

FinanceOps Youtube

FinanceOps Youtube Link: https://www.youtube.com/watch?v=MLpWrANjFbI

FAQ von FinanceOps

Was ist FinanceOps?

FinanceOps ist eine Finanzoperationsplattform, die eine vollständig konforme Chatbot-Lösung bietet, die darauf ausgelegt ist, Inkassoprozesse zu automatisieren. Es integriert sich in beliebte ERP-Tools und nutzt fortschrittliche Algorithmen, um Inkassoprozesse zu optimieren und maximale Ergebnisse zu erzielen. Die Plattform konzentriert sich auf die Rationalisierung von Inkassoprozessen, die Bereitstellung gezielter Interaktionen, die Reduzierung von Gemeinkosten, die Bewältigung erhöhter Volumina und die Einhaltung der US-Schuldeneintreibungsregeln und -gesetze.

Wie benutzt man FinanceOps?

Um FinanceOps zu verwenden, folgen Sie diesen Schritten:n1. Verbinden Sie Ihr ERP-Tool: Wenn Sie bereits ein integriertes ERP-Tool verwenden, können Sie schnell starten, indem Sie es mit FinanceOps verbinden.n2. Integrieren Sie Delinquenzdaten: Mappen und konfigurieren Sie Ihre Kundendelinquenzdaten von ERP-Tools wie QuickBooks, Xero, Sage, NetSuite, Salesforce usw. in das FinanceOps-Dashboard.n3. Passen Sie die Inkassoeinstellungen an: Personalisieren Sie Ihre Inkassoeinstellungen, einschließlich Ton, Kreditkriterien und Abwicklungslimits.n4. Starten Sie den Autopiloten: Lassen Sie FinanceOps die Kontrolle übernehmen mit seinem intelligenten System, das fortschrittliche Algorithmen und personalisierte Strategien verwendet, um Inkassoprozesse zu optimieren und mit Kunden zu interagieren.

Mit welchen ERP-Tools integriert sich FinanceOps?

FinanceOps integriert sich in beliebte ERP-Tools wie QuickBooks, Xero, Sage, NetSuite, Salesforce und andere.

Welche Daten können in FinanceOps gemappt und konfiguriert werden?

In FinanceOps können Sie Kundeninformationen, Rechnungsdetails, Zahlungshistorie, Altersinformationen, Kommunikationshistorie und Kontostatus mappen und konfigurieren.

Hält sich FinanceOps an die Schuldeneintreibungsgesetze?

Ja, FinanceOps ist darauf ausgelegt, innerhalb des Rahmens der US-Schuldeneintreibungsregeln und -gesetze, einschließlich FDCPA, CPA und CCPA, zu arbeiten.

Kann FinanceOps Unterstützung für Inkassoanfragen bieten?

Ja, FinanceOps bietet 24/7 Unterstützung für Inkassoanfragen per SMS. Der Chatbot ist darauf trainiert, eine Vielzahl von 1st-Party-Inkassofragen zu bearbeiten.

Ist FinanceOps kosteneffektiv?

Ja, FinanceOps reduziert Gemeinkosten, indem es Inkassoprozesse rationalisiert, Aufgaben automatisiert und gezielte Interaktionen bereitstellt.